Are you tired of the financial guesswork, constantly wondering how much of your hard-earned money actually ends up in your pocket after taxes and deductions? Understanding your "take-home" pay is critical for effective budgeting, financial planning, and overall peace of mind, especially in a state like California with its complex tax system.

Navigating the intricacies of California's payroll system can feel like traversing a labyrinth. From federal income tax and state income tax to social security and Medicare contributions, the deductions can seem endless. Add to that the varying tax rates depending on your income level, and its easy to feel overwhelmed. Fortunately, numerous online resources and tools exist to simplify the process, empowering both employees and employers to accurately estimate net income. These tools are crucial, offering a clear picture of your finances.

Before diving into the specifics, let's clarify the core concept: "Net pay" or "take-home pay" is the amount of money an employee receives after all deductions have been subtracted from their gross pay. "Gross pay" is the total amount earned before any deductions. The difference between the two can be significant, and it's essential to understand how your gross pay transforms into your net pay.

- Bollyflix Final Destination Your Ultimate Guide To Streaming Bollywood Movies

- Skymovieshdin 2025 The Ultimate Guide To Stream Movies Like A Pro

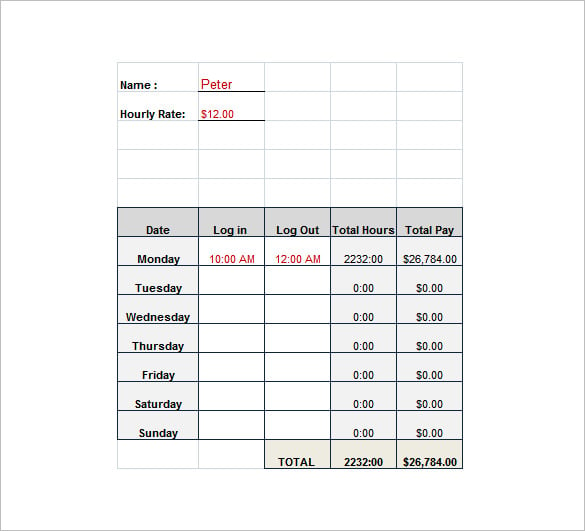

To illustrate this further, consider a hypothetical individual, "Alex," a California resident working a salaried position. Alex's financial profile, as it relates to this article's focus, can be represented in the following table:

| Category | Details |

|---|---|

| Name | Alex (Fictional) |

| Location | California, USA |

| Employment Type | Salaried |

| Annual Salary (Gross) | $75,000 |

| Filing Status | Single |

| Pay Frequency | Bi-weekly |

| Federal Tax Withholding | Based on W-4 form |

| State Tax Withholding | Based on DE-4 form |

| Other Deductions | Health Insurance ($300/month), 401(k) contributions (5% of gross pay) |

| Estimated Take-Home Pay (per pay period) | (Calculated using a paycheck calculator) |

| Relevant Legislation | California tax laws, federal tax laws |

| Reference | California Franchise Tax Board (FTB) |

As demonstrated in Alex's example, determining take-home pay involves several factors. Let's examine these factors and the tools available to assist with the calculations.

The cornerstone of understanding take-home pay is knowing the deductions. These typically include federal income tax, state income tax (California has a progressive income tax system), Social Security and Medicare taxes, and any pre-tax deductions like contributions to a 401(k) or health insurance premiums. The amounts for each deduction are determined by various factors such as your income, filing status, and the specific rules of the tax system.

- Mkvcinemas Com Old Movies Your Ultimate Destination For Retro Cinema

- Hdhub4u Go Your Ultimate Guide To Streaming Movies And Tv Shows

Various online paycheck calculators provide estimates of net pay. These tools, such as those offered by ADP and Smartasset, are designed to simplify the process. They typically ask for information like your gross pay (either hourly wage or annual salary), filing status (single, married, head of household), pay frequency (weekly, bi-weekly, monthly), and any pre-tax deductions you have. Once you enter this information, the calculator does the heavy lifting, estimating your take-home pay after all deductions.

For example, the ADP California Paycheck Calculator is a widely used tool. By entering your wages, tax withholdings, and other relevant information, you can quickly estimate your net pay. Similarly, SmartAssets California Paycheck Calculator provides an estimate of your income after federal, state, and local taxes. PaycheckCity.com also offers a suite of tools, including paycheck calculators and withholding calculators, providing a comprehensive resource for payroll information.

These calculators are updated regularly to reflect changes in tax laws, so it is important to use calculators updated for the current year, such as 2025. Furthermore, the tools available offer a breakdown of the calculations, providing a clear picture of how your gross pay is reduced by various deductions.

Calculating a paycheck in California requires a solid grasp of state and federal tax regulations. For employees, the process begins with determining the pay type: hourly or salaried. Hourly employees have their gross pay calculated based on their hourly rate and the number of hours worked. Salaried employees, on the other hand, have a fixed annual salary, which is typically divided by the number of pay periods in a year to arrive at the gross pay per pay period. For example, if an employee earns an annual salary of $52,000 paid bi-weekly, the gross pay per paycheck would be $2,000.00 (52,000 / 26).

Once the gross pay is determined, the next step is to calculate the deductions. Federal income tax withholding is based on the information provided on the employees W-4 form, while California state income tax withholding is based on the DE-4 form. Other deductions, such as Social Security and Medicare taxes, are calculated based on the employee's gross pay. Additional deductions, like health insurance premiums and retirement contributions, are subtracted to arrive at the net pay.

The state of California employs a progressive income tax system. This means the tax rate increases as the individual's income increases. The tax rates in California can range from 1% to 12.3% depending on the income bracket. Understanding these tax brackets is crucial for estimating your tax liability and take-home pay accurately.

California government employees and other employees who have federal income tax withheld from their wages will also see changes in their paychecks reflecting federal tax updates. It is recommended to use tools like the IRS Tax Withholding Estimator to make sure you have the right amount of tax withheld from your paycheck. This helps to avoid surprises when filing your annual tax return.

In addition to the federal and state income taxes, employees also contribute to Social Security and Medicare. These contributions are calculated as a percentage of the employees gross wages. The employee's portion for Social Security is 6.2%, while the employee's portion for Medicare is 1.45%. The employer also contributes matching amounts for both. Keep in mind that Social Security taxes have a wage base limit, meaning that only earnings up to a certain amount are subject to this tax.

Employees can utilize several strategies to optimize their take-home pay and minimize their tax burden. Contributing to pre-tax retirement accounts, such as 401(k) plans, is one of the most effective. These contributions reduce your taxable income, which lowers your tax liability. In addition, understanding and claiming all eligible tax deductions and credits can further reduce your tax obligations and increase your take-home pay.

Many individuals find themselves asking, "How do I figure out how much money I take home in California?" The process can seem complicated, but tools like paycheck calculators and the insights provided here are designed to help answer that question. By using these tools, individuals gain a clearer understanding of their financial situation, allowing them to plan and budget more effectively. Furthermore, it's always wise to consult with a tax professional or a financial advisor for personalized guidance.

Accurate payroll calculations are crucial for business owners in California. Beyond understanding what you take home, proper payroll ensures compliance with federal and state regulations, and accurate payroll helps employers avoid penalties and legal issues. Payroll service providers, like ADP, often offer comprehensive solutions for managing payroll and benefits, ensuring accurate calculations and compliance. For businesses, investing in robust payroll systems can streamline the process and free up valuable time and resources.

For instance, to calculate the net income for a salaried employee in California, you would start with their annual salary. Then, you would determine the gross pay for each pay period. From there, you would calculate the deductions, including federal income tax, California state income tax, Social Security and Medicare taxes, and any pre-tax deductions. The result is the net pay.

It is important to note that the information provided here is for general guidance only. Tax laws and regulations are subject to change. Always consult with a tax professional or financial advisor for personalized advice tailored to your specific circumstances.

Several websites offer paycheck calculators, including those mentioned previously (ADP, SmartAsset, PaycheckCity), and the California State Controllers Office provides resources. E-filing your taxes with services like FreeTaxUSA can also streamline the process of managing your finances and ensure you're claiming all eligible deductions and credits.

The process of estimating take-home pay in California can be made easier with the aid of reliable tools. The ability to input data like salary, filing status, and pay frequency is one of the greatest advantages of these calculators. The tools then automatically calculate all the deductions, displaying the expected net pay. These calculators not only save time but also reduce the risk of making calculation errors. Some calculators also provide a breakdown of the tax liability, providing information about federal, state, social security, and medicare taxes.

Remember that the goal is to have a clear understanding of your financial obligations and your net income. With a firm understanding of the steps and tools available, you can take control of your finances and make informed decisions. Whether you are an employee or an employer, mastering the basics of payroll calculations is essential for financial success in the Golden State. By utilizing the resources available, you can confidently navigate the complexities of California payroll and secure your financial future.

- Bollyflix Movie Download Your Ultimate Guide To Indian Cinema Bliss

- Bollyflix Day The Ultimate Bollywood Celebration You Canrsquot Miss