Are you tired of the guesswork when it comes to your paycheck? Understanding your "take-home" pay in California is not just beneficial, it's essential for effective budgeting and financial planning.

Navigating the complexities of California payroll can feel like deciphering a code. From federal and state taxes to Medicare and Social Security deductions, the calculations can quickly become overwhelming. But, fear not, several online tools are available to simplify the process and provide clarity on your earnings. These tools are designed to help you estimate your net pay, allowing you to see exactly how much money will land in your bank account after all the necessary deductions.

One of the most crucial aspects of managing your finances is knowing precisely how much you'll receive each payday. In California, where state income tax rates can range from 1% to a hefty 13.30%, understanding the impact of these taxes is paramount. The goal here is to empower you with the knowledge and resources to make informed financial decisions.

- Filmyflyworld Your Ultimate Destination For Entertainment And Beyond

- Bollyfix Movie Your Ultimate Destination For Bollywood Entertainment

Let's delve deeper into the tools available, and how they can help you master the art of California payroll.

Several online paycheck calculators are available. One such tool is offered by ADP. Their calculator requires you to enter your wages, tax withholdings, and other relevant information, and the tool handles the rest of the calculations. Similarly, Smartasset offers a California paycheck calculator that presents your income after federal, state, and local taxes. You simply input your details to see your net pay.

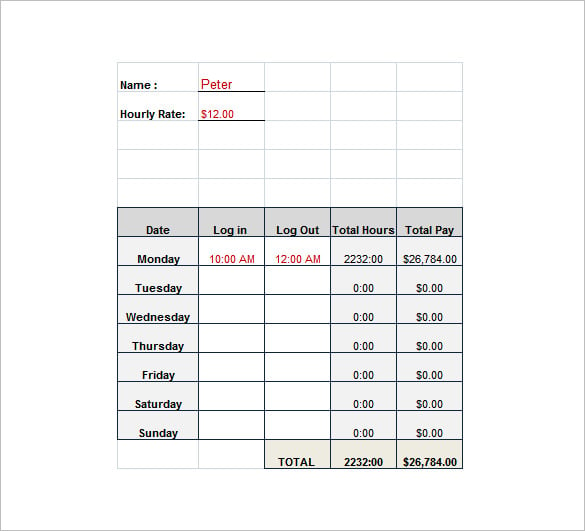

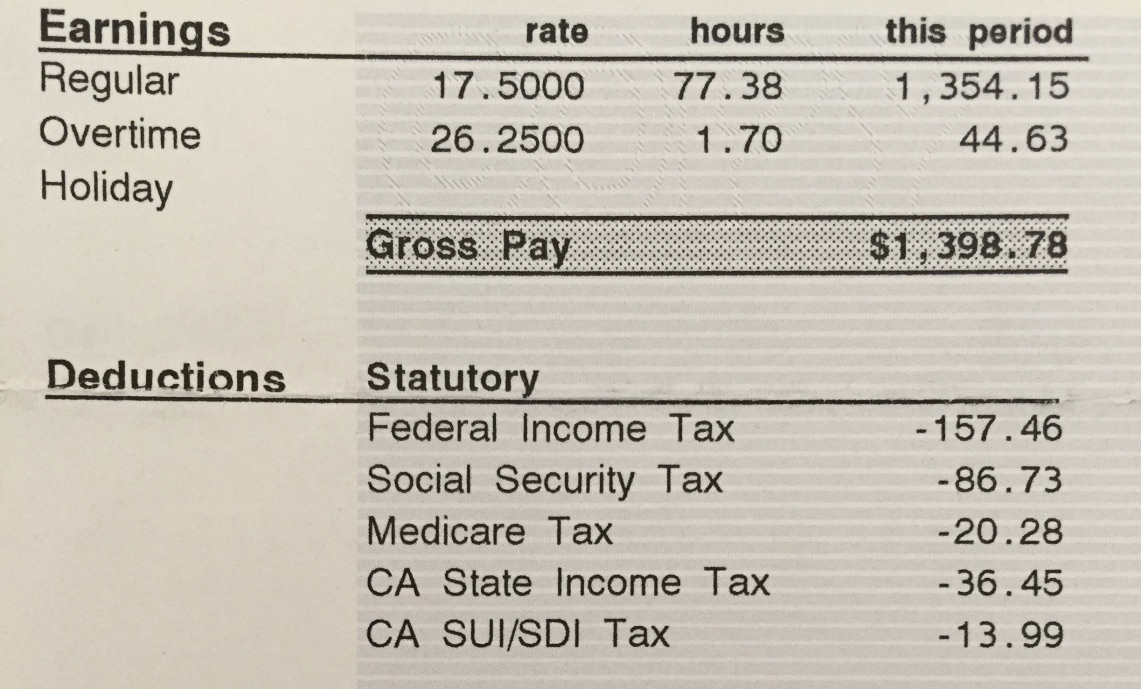

These calculators are useful for hourly and salaried employees alike. For hourly employees, the gross pay is calculated by multiplying the hours worked by the hourly rate. Salaried employees can determine their gross pay by considering the number of pay periods in a year. For example, if a salaried employee earns $52,000 annually and is paid bi-weekly (26 pay periods), the gross pay per paycheck would be $2,000.

- Bollyflix Com Movies Your Ultimate Guide To Bollywood Entertainment

- Bollyflixvip Your Ultimate Destination For Bollywood Entertainment

These online tools typically estimate federal and state taxes, Medicare, and Social Security deductions, allowing for accurate budgeting. They calculate net pay after all taxes have been deducted. California state income tax is applied at a range of 1% to 13.30%, meaning your take-home pay can vary significantly depending on your earnings and the deductions you're subject to. Therefore, using a reliable paycheck calculator is a sound approach to calculating your net pay, whether you're an hourly or a salaried worker.

Government employees in California who withhold federal income tax from their wages saw changes reflected in 2021 payroll. It's crucial for these employees to stay updated with the latest tax regulations. Several resources, including the IRS tax withholding estimator, provide guidance on ensuring the correct amount of tax is withheld from your paycheck. These calculators and estimators are key to accurate calculations and financial planning.

The paycheck calculators consider factors such as gross pay, federal and state taxes, FICA taxes (Medicare and Social Security), and other deductions to estimate the amount of money withheld from your paycheck. When using these calculators, California will be automatically selected as your state, and the tool estimates the taxes deducted from your earnings, including federal, California state, Social Security, and Medicare taxes.

For instance, the "gross pay" for a pay period represents your earnings before any deductions, including wages, tips, and bonuses. You can calculate this from an annual salary by dividing the annual salary by the number of pay periods in a year (e.g., bi-weekly, monthly). Also, the details of the latest tax rates imposed by the government are used by these calculators to ensure precise calculations.

Many online tools and resources are available, such as PaycheckCity.com, offering a range of calculators for California, including paycheck calculators, withholding calculators, and tax calculators, as well as general payroll information. Other tools can determine your net pay based on your gross earnings. These tools often provide a breakdown of your earnings and deductions, offering a clear picture of your finances.

Whether you're calculating your take-home pay for the first time or simply seeking a more accurate way to plan your budget, these resources can be invaluable. These tools are created to give you a clear and precise view of your finances. This allows you to be on top of your money, helping you to be in control of your finances, reducing stress and helping you to achieve your financial goals.

Another advantage of using these tools is the ability to input multiple rates if your income fluctuates. This is particularly useful for those with multiple income streams or those who receive overtime pay. These paycheck calculators provide graphical representations of the calculations. This allows the user to easily understand the information provided in a simplified manner.

Understanding the key information related to California payroll taxes is very important. For those who need to learn more about withholding payroll taxes in California, resources are available. This includes the employee's form DE 4, which is a required form for those living and working in California.

To calculate the percentage of taxes taken out of a paycheck, the total taxes withheld can be divided by the gross pay. The gross pay is the total earnings before any deductions are made. This can give you a better sense of where your money is going.

Several resources explain how to calculate a salary to an hourly wage. This is very useful for those who switch between hourly and salaried roles. Knowing this will allow you to better manage your finances and have a clearer understanding of your income.

Furthermore, for those managing a payroll, California payroll management can be made easy. The ease of using these calculators allows for better payroll management today. The more accessible the tools are, the easier it becomes to manage your finances.

- Hdhub4u Go Your Ultimate Guide To Streaming Movies And Tv Shows

- Unlocking The World Of 1tamilblasters Your Ultimate Guide