Are you tired of guessing how much of your hard-earned money will actually make it into your bank account? Navigating the complexities of California's paycheck deductions can be daunting, but understanding the process is the first step towards financial clarity.

The Golden State, with its vibrant economy and diverse workforce, also boasts a sophisticated tax system. From federal income tax to California state income tax, social security, and Medicare, various deductions chip away at your gross earnings. Fortunately, resources exist to demystify the process and empower you to understand exactly where your money goes. This article delves into the intricacies of calculating your California paycheck, providing you with the knowledge to take control of your finances.

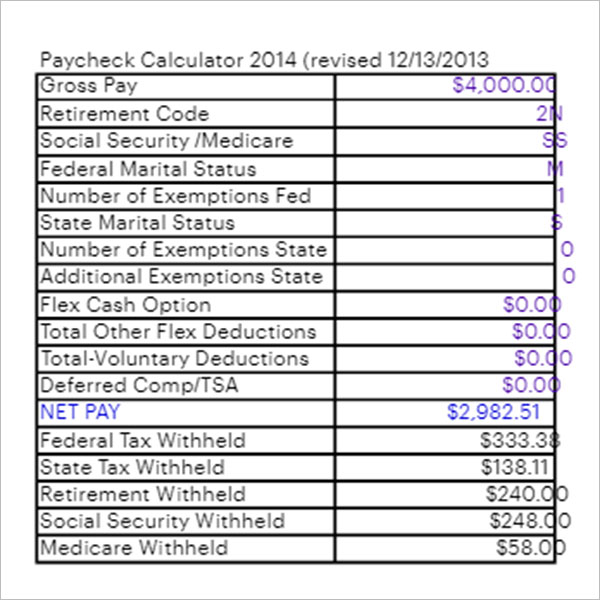

Let's begin with a simplified overview. Calculating a California paycheck involves several key steps. First, you need to determine your gross pay, which is the total amount you've earned before any deductions. This includes your wages, tips, bonuses, and any other form of compensation. Next, you'll subtract various deductions, including federal income tax, California state income tax, social security, Medicare, and any other pre-tax contributions like retirement plans or health insurance premiums. The result is your net pay, or "take-home" pay, which is the amount you actually receive.

- Unpacking The Mysterious World Of Masa49 Org A Comprehensive Guide

- Unlock The Secrets Of My Desinet2 Your Ultimate Guide

To illustrate the impact of these deductions, consider the example of a hypothetical employee in California. Assume this individual earns an annual salary of $60,000 and is paid bi-weekly. Let's break down the key components of their paycheck calculation:

1. Gross Pay: In this case, we divide the annual salary by the number of pay periods (26 in a bi-weekly scenario): $60,000 / 26 = $2,307.69 (approximately) per pay period.

2. Federal Income Tax: This amount will vary depending on the employee's W-4 form (withholding allowances), income level, and any applicable tax credits. For simplicity, let's assume roughly $300 is withheld per pay period.

- Exploring The World Of Mydesi49net Your Ultimate Guide

- Tamilblastersnet The Ultimate Hub For Tamil Movie Enthusiasts

3. California State Income Tax: California's progressive income tax rates range from 1% to 12.3% as of 2025, depending on income brackets. Let's estimate $150 per pay period.

4. Social Security and Medicare: These are FICA (Federal Insurance Contributions Act) taxes. Social Security is 6.2% of your gross pay, and Medicare is 1.45%. For this example, we'll estimate $143 for Social Security and $33 for Medicare.

5. Other Deductions: This might include contributions to a 401(k) plan (e.g., 5% of gross pay, which would be around $115), health insurance premiums (e.g., $100).

6. Net Pay Calculation: Gross Pay - Federal Income Tax - California State Income Tax - Social Security - Medicare - Other Deductions = Net Pay. In our example, this would be approximately $2,307.69 - $300 - $150 - $143 - $33 - $115 - $100 = $1,466.69. This is the employee's estimated take-home pay for that bi-weekly period.

It's important to remember that this is a simplified example. The actual calculations can be far more complex depending on your individual circumstances. Factors such as tax credits, deductions, and other income sources can significantly impact your net pay. For accurate results, it is highly recommended that you use a reliable California paycheck calculator.

Now, consider the tools available to simplify this calculation. Several online resources offer free California paycheck calculators. These tools allow you to input your wages, tax withholdings, and other relevant information to generate an accurate estimate of your net pay. These calculators are particularly useful for budgeting and financial planning. Some popular options include those provided by ADP, SmartAsset, and PaycheckCity. Many of these calculators incorporate the latest tax rates imposed by the government, which is crucial for accurate calculations.

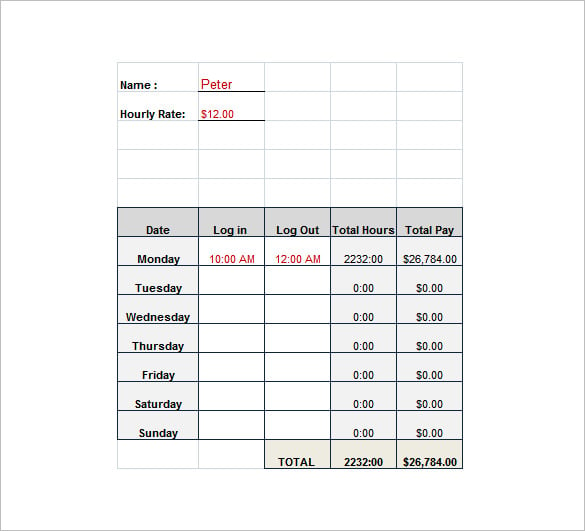

These tools generally require you to enter information like your pay type (hourly or salary), pay rate, pay frequency, and the number of allowances you claimed on your W-4 form. They then calculate your federal income tax, state income tax, social security, and Medicare deductions. Some calculators even allow you to factor in other deductions, such as retirement contributions, health insurance premiums, and other pre-tax benefits.

For example, when using ADPs California paycheck calculator, you simply enter the required wage information, tax withholdings, and any other relevant details. The calculator then handles the complex calculations, providing an estimated take-home pay figure. Similarly, SmartAssets calculator allows you to calculate your income after federal, state, and local taxes, giving you a clear picture of your finances. These tools are essential for ensuring employees see how changes affect their pay and withholding, especially given shifts in tax laws and regulations.

Beyond basic paycheck calculation, these tools also offer valuable insights. By understanding your deductions, you can better manage your finances and plan for the future. You can use the information to estimate your federal and state taxes, as well as Medicare and Social Security deductions, which is critical for accurate budget planning. By seeing your income breakdown, you can make more informed decisions about your spending and savings habits. The ability to estimate your net pay empowers you to create a realistic budget and avoid financial surprises.

Furthermore, these calculators can be used to calculate your hourly or salary income after taking into account federal, state, and local taxes. For hourly employees, understanding your net pay allows you to calculate how much you'll actually receive per hour after deductions. Knowing this figure can help you compare job offers, assess your earnings, and plan accordingly. By dividing your take-home pay by the number of hours you work, you can determine your true hourly wage.

For salaried employees, a paycheck calculator provides a clear picture of your monthly or annual take-home income. This is crucial for financial planning, budgeting, and making important financial decisions. The ability to calculate and analyze your income after taxes provides valuable insight into your financial situation, empowering you to make informed choices about your spending and investments. To further clarify your financial standing, take advantage of tools like the IRS Tax Withholding Estimator, which makes sure you're withholding the right amount of tax.

Let's delve into the specific aspects that make calculating paychecks in California unique. The state has progressive income tax rates, which means the percentage of taxes you pay increases as your income rises. This system affects how your net pay is calculated compared to states with flat tax rates. Currently, California has state income tax rates ranging from 1% to 12.3% (as of 2025), potentially influenced by tax laws, the precise rate is determined by your income bracket. In addition, California employees also contribute to Social Security and Medicare taxes, further affecting the net pay received.

Another critical aspect of California paychecks is the consideration of overtime pay. California labor laws require employers to pay non-exempt employees overtime at a rate of one and a half times their regular rate for any hours worked over eight in a workday, or over 40 hours in a workweek. Double time (twice the regular rate) is required for hours worked over 12 in a workday. This overtime calculation can significantly impact your net pay, especially if you work frequently, including on the weekends or holidays.

The state also has specific rules regarding meal and rest breaks, which must be paid if they are not provided. If you have overtime hours, a California overtime calculator is essential for accurately determining your gross pay and subsequent deductions. The use of these calculators is recommended to calculate the maximum amount of overtime and double overtime pay owed under all methodologies as required by California labor laws.

For California government employees, payroll changes in 2021 highlighted the importance of understanding how tax adjustments reflect in their paychecks. Changes to federal income tax withholding will be reflected in their payroll. The changes could have an impact on the take-home pay, emphasizing the need for tools to help these employees see how such changes affect their pay and withholding.

Many employers use payroll management software to automate the paycheck calculation process. These systems automatically calculate taxes, deductions, and net pay, streamlining the process and reducing the risk of errors. Such software also handles the complexities of California payroll laws, ensuring compliance with all relevant regulations. Managing payroll in California can be made easy with such tools, which is what is the driving force behind their increased adoption.

For those involved in payroll management, understanding how to calculate employee pay is crucial. The process involves determining the pay type (hourly or salary), gross pay, and then subtracting taxes, social security and medicare, and any other applicable deductions. Several tools and resources available to help employers easily manage payroll processes.

Here's a breakdown of what you'll typically find in a California paycheck calculator:

- Gross Pay: The total earnings before any deductions.

- Federal Income Tax Withholding: The amount withheld for federal income taxes.

- California State Income Tax Withholding: The amount withheld for California state income taxes.

- Social Security Tax: 6.2% of your gross pay.

- Medicare Tax: 1.45% of your gross pay.

- Other Deductions: Retirement contributions, health insurance premiums, etc.

- Net Pay: The "take-home" pay after all deductions.

By combining gross pay with an accurate breakdown of taxes, these tools empower you to manage your payroll with ease. It's also important to remember that the frequency of payments (weekly, bi-weekly, semi-monthly, or monthly) can affect your paycheck amount and tax calculations. The timing of payments is typically outlined, like pay is usually on the 15th and the last day of the month.

In conclusion, understanding how to calculate your California paycheck is fundamental for financial well-being. By using online calculators, you can calculate and estimate all your paycheck deductions. By using these tools and understanding the tax laws, you gain control of your earnings, making informed financial decisions and creating a solid foundation for your future. Whether you're an employee or an employer, taking the time to understand your paycheck is an investment in your financial literacy and peace of mind.

- Bollyflixcom Vip Your Ultimate Guide To Streaming Bollywood Movies

- Tonya Westphalen The Inspiring Journey Of A Trailblazer In The Modern Era