Are you prepared for the annual dance with property taxes? Understanding your property tax bill and navigating the payment process is crucial for every homeowner and property owner in New York City, ensuring financial peace of mind and avoiding unnecessary penalties.

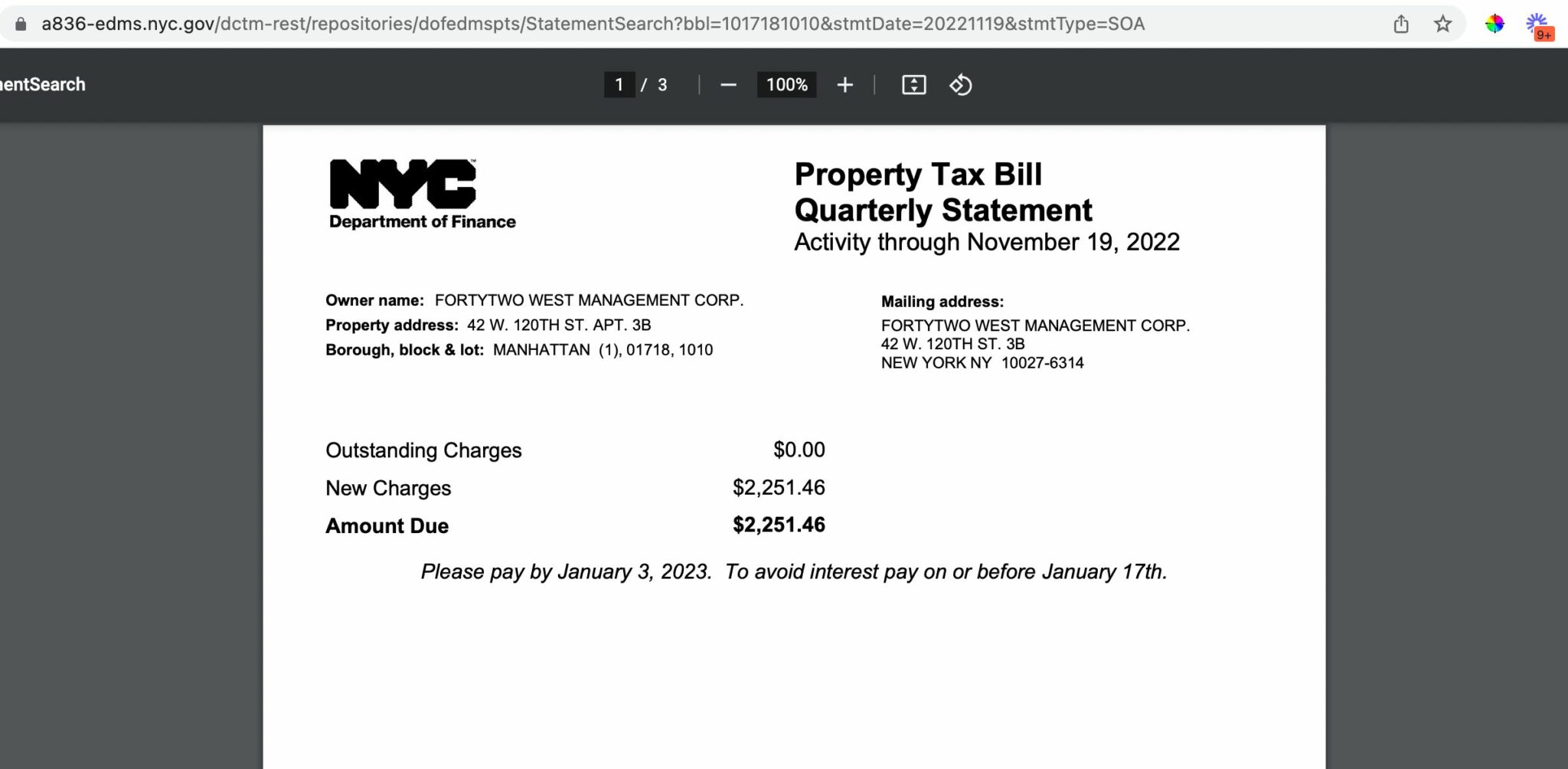

For those who handle their property tax payments independently, a property tax bill will be delivered directly to you. Banks or mortgage companies that manage these payments on your behalf will, conversely, receive the bill. Bills are typically dispatched via mail and also available on the city's website approximately one month before the due date, providing ample time for review and payment planning.

| Key Element | Details |

|---|---|

| Tax Year | July 1 to June 30 (Fiscal Year) |

| Payment Options | Online, By Mail, In Person |

| Online Payment Methods | Credit Card, Electronic Check |

| Payment Scheduling | Through bank websites or online bill pay, or automatic withdrawals |

| Property Search | BBL (Borough, Block, Lot) Number |

| Exemptions and Abatements | Available through online portal |

| Payment Plans | Available for those who qualify, visit property tax payment plan |

| Interest Accrual | Property taxes continue to accrue interest until paid in full |

| City Council | Sets property tax rates annually, usually in November. |

| Tax Rate Determination | Based on your property's tax class |

| Online Portal | NYC Department of Finance |

Paying property taxes is now more convenient than ever. You can schedule payments through your bank's website or online bill pay service. Additionally, the city offers an automatic payment option where the due amount is directly withdrawn from your account each property tax pay period. This ensures timely payments and avoids late fees.

- Alexa Star The Rising Phenomenon Taking Over The Entertainment World

- Skymovieshd South Your Ultimate Movie Streaming Destination

Regardless of how you file your return, remember that income tax payments are handled through online services. The ability to make payments or schedule them is available on any day leading up to and including the due date. For those who have filed for an extension, ensure your extension payment is made by the original due date.

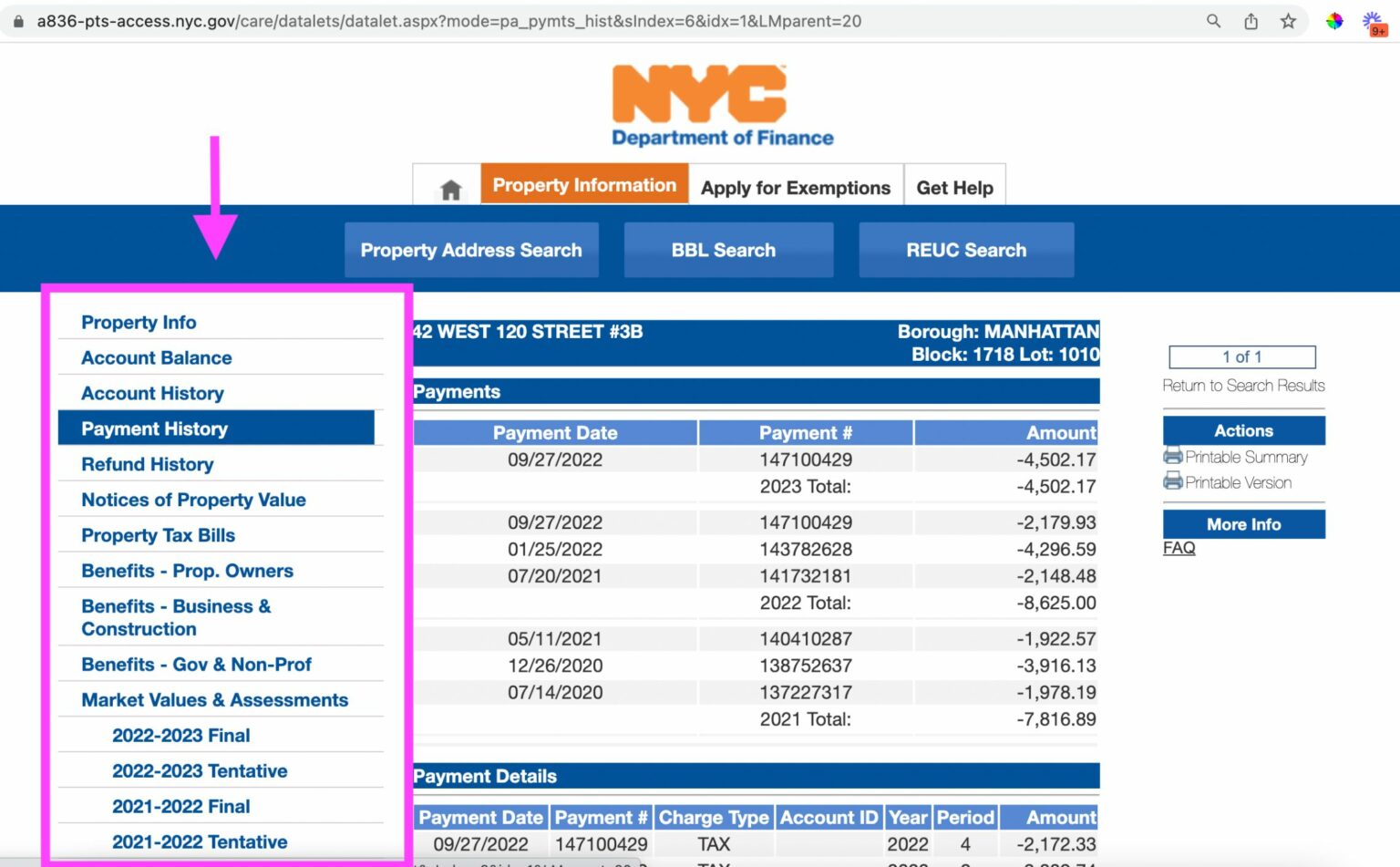

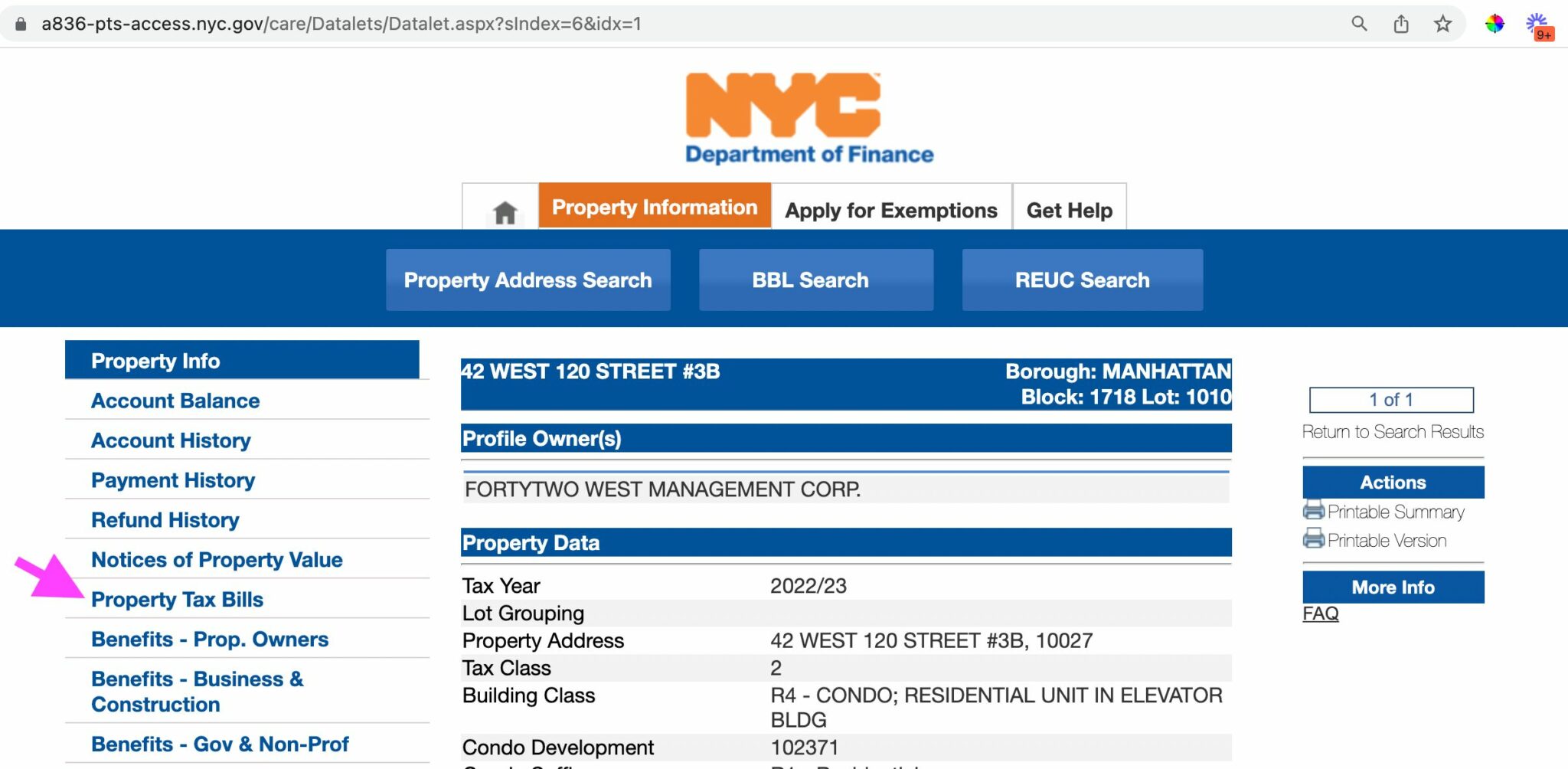

To begin your property tax journey online, start by entering your BBL (Borough Block Lot) number. Click the "register" button to set up your account and begin using the system. This portal also allows you to explore property records, access information via ACRIS, and apply for tax exemptions and abatements. Moreover, you can view your property tax bills, annual notices of property value (NOPV), and other important statements online.

If you have questions or require clarification, the city provides contact information to assist you. Remember that the NYC Department of Finance offers online property tax payment, property record exploration, access to ACRIS, and applications for tax exemptions and abatements. Keep in mind that "NYC" is a trademark and service mark of the City of New York.

- Www Filmyfly Com 2025 Your Ultimate Guide To Movie Downloads And Streaming

- Alyx Setr The Rising Star In Gaming And Beyond

Your property tax rate, which determines the tax you owe, is directly tied to your tax class. These rates are set annually by the New York City Council, typically in November. For the tax year beginning July 1, 2024, and ending June 30, 2025, new property tax rates have been adopted. These new rates will be reflected on the January 2025 property tax bills. New York City operates on a tax year (fiscal year) that spans from July 1 to June 30.

For more information on payment plans, explore the property tax payment plan. When you enroll in monthly property tax bill payments, you effectively pay your upcoming property taxes in advance. Payments will commence on the first day of the month following your enrollment. Notably, these monthly payments do not include past due taxes, which must be settled separately. Once your plan is established, you're responsible for both current property taxes and your scheduled payment under the plan.

Property taxes, it's important to remember, continue to accrue interest until the balance is paid in full. From July 1, 2024, through June 30, 2025, reduced interest and payment plans may be available. Properties with an assessed value of $250,000 or less may qualify for special programs. The more you pay upfront, the lower your subsequent payments will be. These payment plans offer flexibility, allowing payments monthly or quarterly for up to 10 years. The payment agreement estimator is a helpful tool to estimate your payment amount.

For those needing to pay for street parking, the ParkNYC app and website offer a convenient solution. If you need to pay a property tax bill directly, you can do so via the designated property tax payment system. Installment plans are available for sidewalk repairs made by the Department of Transportation. You can also pay your water and sewer bill online. When searching for information, ensure you fill in all required fields to ensure accurate results.

You can also pay property taxes online using the CityPay portal. The "CityPay" system allows you to enter your BBL and proceed with payments. Always register and begin using the system via the register button. For parking ticket-related information, visit nyc.gov/finance. If you believe you have been the victim of an internet crime, report it online to the Internet Crime Complaint Center (IC3) at www.ic3.gov.

The online services are available at all times, with the exception of scheduled maintenance periods. You can pay directly from your preferred account or using a credit card through your individual online services account. Online services provide the fastest and most convenient method for conducting business with the tax department. Create an online services account to manage payments, respond to department letters, and more, anytime, anywhere. It's easy to create an account if you dont already have one.

In addition to online payment, property taxes can be paid in person at City Hall, 1st floor, room 108, at the cashier's office. You can also pay online, via credit card, or using an electronic check. Mobile tax payment centers are available in the City of Yonkers on specified dates. Also, remember to consult your software provider to determine if they offer estimated tax payments for personal income tax purposes.

The NYC Department of Finance's property tax public access web portal is a valuable resource. You can look up property information, including its tax class and market value. The Department for the Aging also issues violations to SADC providers that violate New York City Local Law 9 and New York State Office for the Aging social adult day services standards. All registration submissions and violation payments can only be completed online.

Regarding county and town taxes: The first payment, due January 15th, is paid to the receiver of your town. The 2nd, 3rd, and 4th payments are paid to the commissioner of finance and can be processed through our online payment system. You can also pay your county taxes online. Please consult the online resources for general county and town tax information. In each town, property taxes are paid to the receiver in equal installments. Payment can be made online via the 10701 phone system.

Remember that any ny.gov website belongs to an official New York State government organization. Always verify the source when handling financial information online.

- Www Filmyflycom Your Ultimate Destination For Movies And Entertainment

- Filmyflyworld Your Ultimate Destination For Entertainment And Beyond